FIRE Movement Calculator: Calculate Your Financial Independence Retirement Early Timeline

Imagine a life where work is optional, where your days are filled with passion projects and quality time with loved ones. Sounds like a dream, right? Well, for many, it's an achievable goal thanks to the FIRE movement.

Figuring out exactly when you can pull the plug and embrace that freedom can feel overwhelming. Sifting through endless spreadsheets, making assumptions about future market returns, and trying to factor in unexpected expenses can quickly turn your dream into a mathematical nightmare. You might feel like you're missing a crucial piece of the puzzle, leaving you stuck in a cycle of doubt and uncertainty about your financial future.

This article aims to empower you with a crucial tool: a FIRE movement calculator, designed to help you map out your journey to financial independence and early retirement. By understanding the key factors that influence your timeline, you can take control of your finances and accelerate your path toward a life of freedom and purpose.

This article explored the power of a FIRE (Financial Independence, Retire Early) movement calculator. We discussed its benefits, delved into its history, revealed some hidden secrets, and offered recommendations for use. We covered essential tips and fun facts, and even addressed what happens if things don't go according to plan. Armed with this knowledge, you can confidently use a FIRE calculator to chart your course toward a financially independent future.

My Personal FIRE Journey and the Calculator's Role

I remember when I first stumbled upon the FIRE movement. The idea of retiring in my 40s seemed like a pipe dream, something reserved for the ultra-wealthy. My initial attempts at planning felt haphazard. I was juggling multiple savings accounts, unsure of how much to allocate where, and completely lost when it came to projecting investment growth. I was essentially throwing darts at a board, hoping something would stick.

That's when I discovered FIRE calculators. They provided a much-needed framework, forcing me to confront my spending habits, savings rate, and investment strategies. Suddenly, the abstract goal of early retirement felt tangible. I could see how increasing my savings rate by just a few percentage points could shave years off my timeline. The calculator became my accountability partner, a tool that kept me focused and motivated.

A FIRE calculator is more than just a simple financial tool; it's a roadmap to your future freedom. By inputting your current financial situation – your income, expenses, savings, and investments – it projects how long it will take to reach your financial independence number. This number represents the amount of money you need to have invested so that the returns can cover your annual living expenses without you having to work a traditional job. The calculator usually factors in assumptions about investment growth rates, inflation, and withdrawal rates (often using the 4% rule, which suggests withdrawing 4% of your portfolio each year). Understanding these projections empowers you to make informed decisions about your finances, allowing you to adjust your savings, spending, or investment strategies to accelerate your journey to FIRE.

Understanding the FIRE Movement Calculator

At its core, a FIRE movement calculator is a tool designed to project how long it will take you to reach financial independence and retire early. It functions by analyzing your current financial situation – income, expenses, savings, and investments – and making projections based on various assumptions about future market performance, inflation, and your withdrawal rate during retirement. The ultimate output is an estimated timeline, showing you how many years it will take to accumulate enough wealth to cover your living expenses without needing to work.

The power of a FIRE calculator lies in its ability to provide clarity and control. Instead of vaguely aiming for retirement "someday," you gain a concrete understanding of the steps you need to take to achieve your goal. By playing with different scenarios – increasing your savings rate, reducing your expenses, or optimizing your investment strategy – you can see the direct impact on your retirement timeline. This empowers you to make informed decisions and adjust your lifestyle to accelerate your path toward financial independence. Moreover, the calculator can help you identify potential pitfalls, such as overly optimistic investment projections or unsustainable spending habits, allowing you to make course corrections before they derail your plans.

While the precise formulas vary between different FIRE calculators, they all rely on the same core principles: calculating your financial independence number (typically 25-30 times your annual expenses) and projecting how long it will take to accumulate that amount based on your savings rate and investment returns. By understanding these underlying mechanics, you can use the calculator not just as a passive tool, but as an active instrument for planning and managing your financial future.

The History and Myth of FIRE Movement Calculators

The FIRE movement itself has roots in the principles of minimalism, frugality, and strategic investing, popularized by books like "Your Money or Your Life" by Vicki Robin and Joe Dominguez. While FIRE calculators as we know them today are relatively recent developments, the concept of using financial models to plan for retirement has been around for decades. Early retirement planning tools often focused on traditional retirement ages, but the FIRE movement shifted the focus to achieving financial independence at a much younger age, creating a demand for calculators tailored to this specific goal.

One of the biggest myths surrounding FIRE calculators is that they are infallible. While they can provide valuable insights and projections, it's crucial to remember that they are based on assumptions about the future, which is inherently uncertain. Market downturns, unexpected expenses, and changes in personal circumstances can all impact your FIRE timeline. Another myth is that FIRE calculators are only useful for people with high incomes. While it's true that a higher income can accelerate the process, FIRE is achievable for people at various income levels. It's all about maximizing your savings rate and making smart financial choices.

It's important to view FIRE calculators as tools, not oracles. They should be used to inform your decisions, not dictate them. Regularly revisit your calculations, adjust your assumptions based on changing circumstances, and be prepared to adapt your plan as needed. With a healthy dose of skepticism and a proactive approach, FIRE calculators can be powerful assets on your journey to financial independence.

The Hidden Secrets of a FIRE Movement Calculator

While FIRE calculators appear straightforward, they often hide subtle nuances that can significantly impact your results. One secret lies in understanding the assumptions built into the calculator. Most calculators allow you to customize assumptions like investment growth rate and inflation, but many users simply accept the default values without carefully considering their appropriateness. A seemingly small adjustment to these assumptions can drastically alter your projected retirement date.

Another hidden secret is the importance of accurately estimating your expenses. Many people underestimate their true spending, especially when it comes to discretionary expenses like dining out and entertainment. It's crucial to track your spending meticulously for several months to get a realistic picture of your expenses. Also, consider how your expenses might change in retirement. Will you be traveling more? Will you have higher healthcare costs? Factoring in these potential changes is essential for accurate projections.

The most significant hidden secret is that a FIRE calculator is just one piece of the puzzle. It's a tool for planning, but it's not a substitute for taking action. You need to actively manage your finances, invest wisely, and continually monitor your progress. By understanding the underlying assumptions, accurately estimating your expenses, and using the calculator in conjunction with sound financial practices, you can unlock its full potential and accelerate your journey to financial independence.

Recommendations for Using a FIRE Movement Calculator

If you're serious about pursuing FIRE, incorporating a FIRE movement calculator into your planning process is essential. However, not all calculators are created equal, and using them effectively requires a thoughtful approach. My first recommendation is to try out several different calculators. There are many free options available online, each with its own strengths and weaknesses. Experimenting with different calculators will give you a broader perspective and help you identify the features that are most important to you.

Next, be realistic with your assumptions. It's tempting to plug in optimistic investment growth rates, but it's better to err on the side of caution. Consider using historical market averages or even slightly lower values to account for potential downturns. Also, be honest about your spending habits. Don't underestimate your expenses or assume you'll magically become more frugal in retirement. It's better to have a conservative estimate that you can comfortably meet than an unrealistic goal that sets you up for disappointment.

Finally, treat the calculator as a dynamic tool, not a one-time exercise. Regularly update your inputs as your income, expenses, and investments change. Revisit your assumptions periodically and adjust them as needed. By actively engaging with the calculator and incorporating it into your ongoing financial planning, you can stay on track and make informed decisions as you pursue your FIRE goals.

Deeper Dive into Investment Strategies and the FIRE Calculator

The investment strategy you choose plays a huge role in determining your FIRE timeline, and it's a critical input for your FIRE calculator. A more aggressive investment strategy, such as investing primarily in stocks, has the potential for higher returns, but it also comes with greater risk. A more conservative strategy, such as investing in bonds or real estate, may provide lower returns but also offers greater stability.

When using a FIRE calculator, it's important to understand how your chosen investment strategy will impact your projected growth rate. You can use historical data to estimate the average returns of different asset classes, but remember that past performance is not a guarantee of future results. Also, consider the tax implications of your investment strategy. Some investments are taxed more heavily than others, which can reduce your overall returns.

The FIRE calculator can help you model different investment scenarios and see how they affect your retirement timeline. Try plugging in different growth rates to see how a more aggressive or conservative strategy would impact your results. You can also use the calculator to experiment with different asset allocations, such as increasing your allocation to stocks or bonds. By carefully considering your investment strategy and using the FIRE calculator to model different scenarios, you can make informed decisions that align with your risk tolerance and financial goals.

Essential Tips for Maximizing Your FIRE Calculator

To truly harness the power of a FIRE calculator, consider these key tips. First, track your net worth meticulously. Your net worth – the difference between your assets and liabilities – is the foundation for calculating your progress toward financial independence. Use a spreadsheet or a personal finance app to track your assets, including your savings accounts, investments, real estate, and any other valuable possessions. Also, track your liabilities, such as your mortgage, student loans, and credit card debt. Regularly updating your net worth will give you a clear picture of your financial standing and allow you to accurately input this data into your FIRE calculator.

Second, optimize your savings rate aggressively. The faster you save, the sooner you'll reach your financial independence number. Look for ways to cut unnecessary expenses and redirect those savings toward your investments. Consider automating your savings by setting up automatic transfers from your checking account to your investment accounts. This ensures that you're consistently saving and investing, even when you're busy or tempted to spend.

Finally, diversify your income streams. Relying solely on your primary job for income can be risky, especially if you're pursuing early retirement. Explore opportunities to generate passive income, such as investing in dividend-paying stocks, renting out a property, or creating and selling online courses or products. Diversifying your income streams not only accelerates your progress toward FIRE but also provides a safety net in case of job loss or other unexpected events. By following these tips, you can maximize the effectiveness of your FIRE calculator and significantly increase your chances of achieving financial independence and early retirement.

Understanding the 4% Rule and Its Limitations

The 4% rule is a cornerstone of the FIRE movement, and it's often used in FIRE calculators to estimate sustainable withdrawal rates during retirement. The rule suggests that you can safely withdraw 4% of your portfolio each year, adjusted for inflation, without running out of money. This rule is based on historical data and simulations, but it's important to understand its limitations.

The 4% rule is not a guarantee. It's based on average market returns over long periods, and there's no guarantee that future returns will be the same. Also, the rule doesn't account for individual circumstances, such as longevity, healthcare costs, or unexpected expenses. Some studies suggest that a slightly lower withdrawal rate, such as 3.5% or 3%, may be more sustainable in the long run, especially for those planning to retire very early.

When using a FIRE calculator, consider experimenting with different withdrawal rates to see how they impact your projected retirement timeline. You can also use the calculator to model different scenarios, such as a market downturn or a period of high inflation, to assess the resilience of your FIRE plan. By understanding the limitations of the 4% rule and using the FIRE calculator to explore different scenarios, you can create a more robust and sustainable FIRE plan.

Fun Facts About FIRE Movement Calculators

Did you know that some FIRE calculators incorporate Monte Carlo simulations? These simulations run thousands of different market scenarios to provide a range of possible outcomes, giving you a more realistic view of the uncertainty involved in retirement planning. It's like having a virtual crystal ball that shows you the potential ups and downs of your FIRE journey.

Another fun fact is that FIRE calculators have evolved significantly over time. Early calculators were often simple spreadsheets with basic formulas, but modern calculators incorporate sophisticated algorithms and data visualizations to provide more accurate and user-friendly projections. Some calculators even integrate with personal finance apps to automatically track your spending and investments.

One of the most interesting things about FIRE calculators is that they're not just for people pursuing FIRE. They can also be valuable tools for anyone who wants to gain a better understanding of their finances and plan for the future. By using a FIRE calculator, you can gain insights into your spending habits, savings rate, and investment strategy, and make informed decisions that will help you achieve your financial goals, regardless of whether you're planning to retire early or not.

How to Build Your Own FIRE Movement Calculator

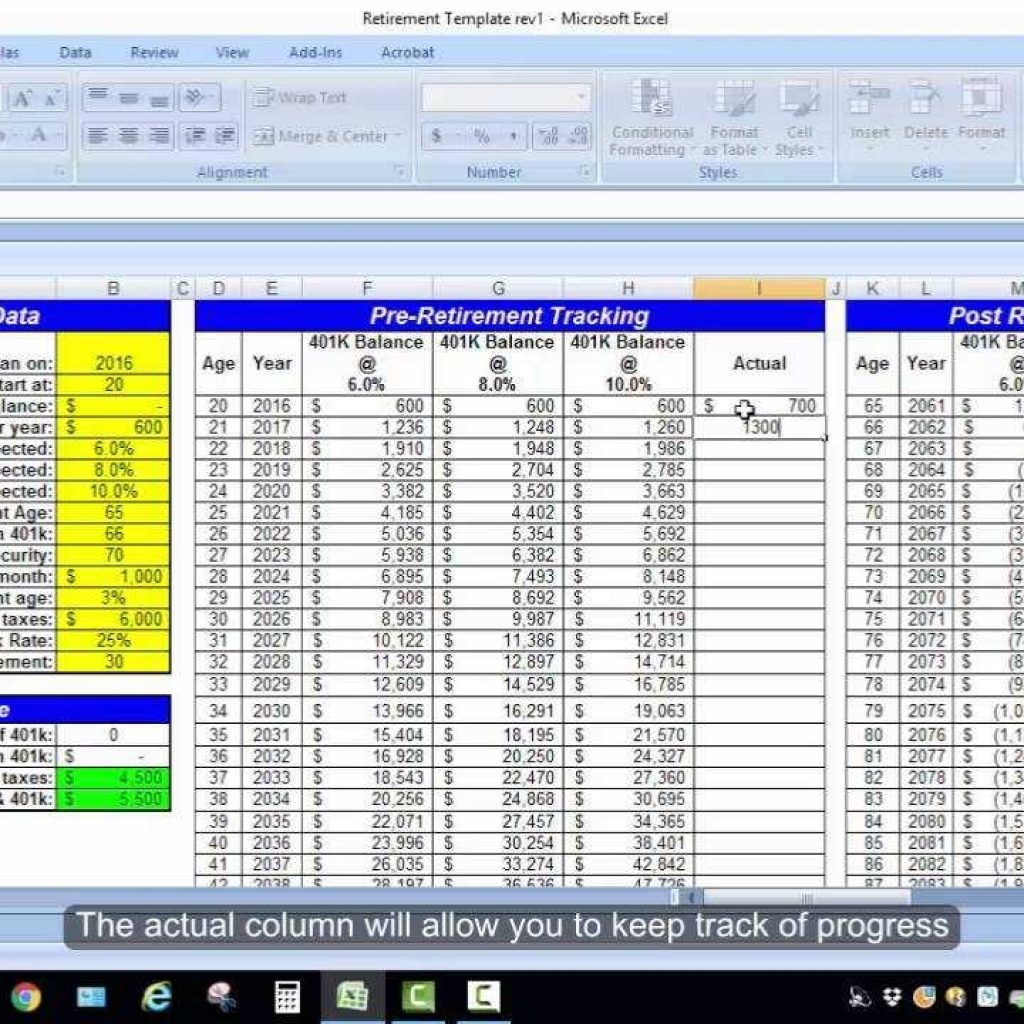

While there are numerous excellent FIRE calculators available online, building your own can provide a deeper understanding of the underlying calculations and allow you to customize the tool to your specific needs. The simplest approach is to use a spreadsheet program like Google Sheets or Microsoft Excel. Start by creating columns for your income, expenses, savings, investments, and other relevant financial data.

Next, create formulas to calculate your savings rate, investment growth, and projected retirement date. You can use the 4% rule to estimate your sustainable withdrawal rate during retirement. You can also incorporate assumptions about inflation and tax rates to make your projections more realistic. As you build your calculator, be sure to label your cells clearly and add comments to explain your formulas. This will make it easier to understand and update your calculator in the future.

Building your own FIRE calculator is a great way to deepen your understanding of personal finance and take control of your retirement planning. It can be a challenging but rewarding project that will empower you to make informed decisions about your financial future.

What If Your FIRE Movement Calculator Timeline Changes?

Life is unpredictable, and your FIRE timeline is likely to change over time. Market downturns, job losses, unexpected expenses, and changes in personal circumstances can all impact your progress toward financial independence. It's important to be prepared for these eventualities and have a plan for adjusting your FIRE strategy as needed.

If your FIRE timeline gets pushed back due to unforeseen circumstances, don't get discouraged. Instead, reassess your financial situation and identify areas where you can make adjustments. Consider cutting expenses, increasing your savings rate, or diversifying your income streams. You can also adjust your investment strategy to potentially increase your returns, although this comes with added risk.

Remember that FIRE is a journey, not a destination. It's about making intentional choices that align with your values and goals. If your timeline changes, don't be afraid to adapt your plan. The most important thing is to stay focused on your long-term goals and continue making progress, even if it's slower than you originally anticipated. Use your FIRE calculator as a tool to guide your decision-making and keep you on track toward financial independence.

Listicle: Top 5 Ways a FIRE Calculator Can Help You

1.Gain Clarity on Your Retirement Timeline: A FIRE calculator provides a realistic estimate of how long it will take you to reach financial independence, transforming a vague dream into a concrete goal.

2.Identify Areas for Improvement: By analyzing your income, expenses, and savings rate, a FIRE calculator highlights areas where you can optimize your finances to accelerate your FIRE journey.

3.Model Different Scenarios: Experiment with different savings rates, investment strategies, and withdrawal rates to see how they impact your retirement timeline and make informed decisions.

4.Stay Motivated and Accountable: Tracking your progress with a FIRE calculator provides ongoing feedback and keeps you motivated to stay on track toward your financial goals.

5.Adapt to Changing Circumstances: Regularly update your FIRE calculator with new information and adjust your plan as needed to stay on course, even when life throws you curveballs.

Question and Answer

Q: What is the most important input for a FIRE calculator?

A: While several inputs are important, your savings rate is arguably the most impactful. The higher your savings rate, the faster you'll accumulate wealth and reach financial independence.

Q: Can a FIRE calculator guarantee that I'll retire early?

A: No. A FIRE calculator is a planning tool, not a crystal ball. It provides projections based on assumptions about the future, which are inherently uncertain.

Q: What is the 4% rule?

A: The 4% rule is a guideline that suggests you can safely withdraw 4% of your retirement portfolio each year, adjusted for inflation, without running out of money.

Q: Where can I find a good FIRE calculator?

A: There are many free FIRE calculators available online. Some popular options include those offered by Nerd Wallet, Bankrate, and Personal Capital. Experiment with different calculators to find one that suits your needs.

Conclusion of FIRE Movement Calculator: Calculate Your Financial Independence Retirement Early Timeline

Post a Comment