Rule of 55 for FIRE Movement: Access 401k Funds Before Age 59.5

Imagine a life where you can retire early, pursue your passions, and not be shackled to a 9-to-5 job well into your sixties. The FIRE (Financial Independence, Retire Early) movement is all about achieving this dream. But what if you need to access your 401k funds before the traditional retirement age of 59.5? That’s where the Rule of 55 comes in, offering a potential pathway to early retirement without hefty penalties.

The allure of retiring early is powerful, yet the practicalities can be daunting. Concerns about healthcare costs, managing investments for the long haul, and, perhaps most pressingly, accessing retirement funds before the standard age are common hurdles for those pursuing FIRE. Navigating these challenges requires careful planning and a thorough understanding of the available options.

This blog post will explore the Rule of 55, a little-known provision in the U.S. tax code that allows eligible individuals to withdraw money from their 401k without penalty as early as age 55. We’ll delve into the specifics of the rule, its benefits, its limitations, and how it can be a valuable tool for those seeking financial independence and early retirement.

In this article, we'll break down the ins and outs of the Rule of 55, a crucial concept for anyone in the FIRE movement aiming to tap into their 401k funds before the age of 59.5. We'll explore its eligibility requirements, potential advantages, and important considerations to help you determine if it's the right strategy for your early retirement plan. Keywords: Rule of 55, FIRE Movement, 401k, early retirement, retirement planning, financial independence, penalty-free withdrawals.

The Rule of 55: A Personal Anecdote

I remember when I first stumbled upon the Rule of 55. I was deep in the throes of FIRE research, crunching numbers and agonizing over spreadsheets. The thought of waiting until

59.5 to access my hard-earned 401k felt like an eternity. Then, I saw it – a glimmer of hope amidst the retirement planning complexities. The Rule of 55 seemed almost too good to be true, a loophole that could shave years off my projected retirement timeline. I was working for a company I didn’t particularly enjoy, and the thought of escaping felt incredibly liberating. But I soon realized it wasn't a magic bullet. It came with its own set of caveats and requirements that needed careful consideration. One of the biggest factors to consider is the tax implications of early withdrawals. It's very important to understand how these withdrawals will impact your overall tax burden and adjust your FIRE strategy accordingly.

The Rule of 55 applies specifically to your 401k (or 403b) from yourlastemployer. This is a critical point often missed. If you've rolled over previous 401k accounts into an IRA, those funds arenoteligible under the Rule of 55. You can only access the 401k associated with the job you left at age 55 or later. This means strategizing your career moves is crucial. You might even consider a lateral move to a different company closer to your target retirement age simply to gain access to this rule. A further thing to keep in mind is that this rule only applies if you leave your job during or after the year you turn

55. It does not apply if you quit your job at 54 and delay taking distributions until you turn

55.

What Exactly Is the Rule of 55?

The Rule of 55, in essence, is an IRS provision that allows you to withdraw funds from your 401(k) or 403(b) without incurring the standard 10% early withdrawal penalty if you leave your job during or after the year you turn 55. This rule is a game-changer for those pursuing early retirement, offering a significant advantage over the traditional requirement of waiting until age

59.5. However, it's crucial to understand that this rule appliesonlyto the 401(k) or 403(b) account associated with the employer you left. Any funds rolled over into an IRA or other retirement accounts are not eligible under this rule and would still be subject to the 10% penalty if withdrawn before age

59.5.

The intent behind the Rule of 55 is to provide a safety net for individuals who may be forced into early retirement due to unforeseen circumstances, such as job loss or health issues. It allows them to access their retirement savings without being penalized, providing much-needed financial flexibility during a potentially vulnerable time. But it’s not just for forced retirees; it’s also a powerful tool for those who proactively choose early retirement as part of their FIRE strategy. Carefully consider your financial needs and withdrawal strategy before tapping into your 401(k) under the Rule of 55. Consult with a financial advisor to ensure you're making informed decisions that align with your long-term financial goals. One other important consideration is the impact on healthcare costs. Retiring early often means you'll need to find alternative health insurance options, which can be costly. Factor these expenses into your retirement plan to ensure you have adequate coverage.

History and Myths Surrounding the Rule of 55

The Rule of 55 wasn't born overnight. It emerged as part of broader legislative efforts to address the evolving needs of the American workforce and the changing landscape of retirement. Its initial intention was to provide a safety net for those unexpectedly displaced from their jobs later in their careers. Over time, it has become a valuable tool for those proactively planning for early retirement.

One common myth surrounding the Rule of 55 is that it applies toallof your retirement accounts. This is simply not true. It only applies to the 401(k) or 403(b) associated with yourlastemployer from whom you separated service during or after the year you turned 55. Another misconception is that you can withdraw any amount you want penalty-free. While there's no penalty, the withdrawals are still subject to income tax. This can significantly impact your overall tax burden, so careful planning is essential. Some also believe that once you start taking distributions under the Rule of 55, you're locked in and can't change your withdrawal strategy. However, you have flexibility in adjusting your withdrawals based on your changing financial needs, so long as you adhere to the rules. The Rule of 55 is a great tool that should be used, and by making sure that you know the ins and outs of it you will be very successful.

The Hidden Secrets of the Rule of 55

While the basic premise of the Rule of 55 is straightforward, there are some lesser-known nuances that can significantly impact your early retirement strategy. One hidden secret is the "one-separation-from-service" rule. This means that the Rule of 55 applies only if you separate from service (leave your job) during or after the year you turn 55. If you leave your jobbeforethe year you turn 55, even if you wait until age 55 or later to take distributions, you willnotbe eligible for penalty-free withdrawals under this rule.

Another key consideration is the impact on your future Social Security benefits. While withdrawing funds from your 401(k) under the Rule of 55 doesn't directly affect your Social Security eligibility, it can indirectly influence your benefits. By accessing your retirement savings early, you may reduce the amount of time your money has to grow, potentially impacting your overall retirement income. This is why it’s crucial to carefully consider your withdrawal rate and investment strategy to ensure you have enough income to support yourself throughout retirement. There is also something called the "substantially equal periodic payments" (SEPP) rule. This allows you to avoid the 10% penalty on early distributions from IRAs, but it requires you to take a fixed amount annually for at least five years or until age 59.5, whichever is later. It's a different strategy than the Rule of 55, but it's another option to consider for early retirement income.

Recommendations for Leveraging the Rule of 55

If you're seriously considering leveraging the Rule of 55 for your FIRE journey, there are several key recommendations to keep in mind. First and foremost, thorough financial planning is paramount. Before making any decisions about early retirement, work with a qualified financial advisor to assess your current financial situation, project your future expenses, and develop a sustainable withdrawal strategy. This will help you determine if the Rule of 55 is the right fit for your needs and ensure you don't outlive your savings.

Another important recommendation is to carefully evaluate your healthcare options. Retiring early often means you'll need to find alternative health insurance coverage, such as through the Affordable Care Act (ACA) marketplace or a private plan. Healthcare costs can be a significant expense in retirement, so it's essential to factor these into your financial plan. Consider the costs of premiums, deductibles, and out-of-pocket expenses to ensure you have adequate coverage without breaking the bank. Next, it is important to stay informed about changes in tax laws and regulations that could affect your retirement income. Tax laws are constantly evolving, and it's crucial to stay up-to-date to minimize your tax liability and maximize your retirement savings. Consider consulting with a tax professional to ensure you're making tax-efficient decisions. Finally, consider creating a diversified investment portfolio to mitigate risk and maximize returns. Diversification is key to protecting your savings from market volatility and ensuring your investments grow over time.

Understanding the "Separation from Service" Requirement

The "separation from service" requirement is a critical aspect of the Rule of 55 that often causes confusion. It essentially means that you must leave your job during or after the year you turn 55 to be eligible for penalty-free withdrawals from your 401(k) or 403(b) associated with that employer. This rule is strict, and there are no exceptions for individuals who leave their jobs before age 55, even if they wait until age 55 or later to begin taking distributions.

The IRS defines "separation from service" as the termination of your employment with an employer. This can include quitting, being laid off, or being fired. However, it doesnotinclude transferring to a different department within the same company or taking a leave of absence. To qualify for the Rule of 55, you must genuinely end your employment relationship with the employer sponsoring the 401(k) or 403(b) plan. Now, let's consider some practical examples. Imagine you turn 55 in June of this year. If you leave your job anytime during this year, you would meet the "separation from service" requirement and be eligible for penalty-free withdrawals from your 401(k). However, if you had left your job last year, even if you are now 55, you wouldnotqualify. Also, there are some exceptions for public safety employees, such as firefighters and law enforcement officers. They can access their retirement funds as early as age 50, provided they meet certain requirements. These exceptions recognize the physically demanding nature of these professions and the need for earlier retirement options.

Top Tips for Maximizing the Rule of 55

To truly maximize the benefits of the Rule of 55, you need to go beyond just understanding the basic requirements. Strategic planning and proactive decision-making are key to ensuring a successful early retirement. One of the most important tips is to carefully coordinate your retirement date with your 55th birthday. If possible, aim to leave your job sometime during the year you turn 55 to ensure you meet the "separation from service" requirement. This may involve some careful timing and coordination with your employer.

Another crucial tip is to avoid rolling over your 401(k) to an IRA before utilizing the Rule of 55. Remember, the Rule of 55 only applies to the 401(k) or 403(b) associated with your last employer. Once you roll those funds over to an IRA, they are no longer eligible under the Rule of 55 and would be subject to the 10% early withdrawal penalty if taken before age

59.5. If you have multiple 401(k) accounts from previous employers, consider consolidating them into your current 401(k) to simplify your retirement planning and potentially take advantage of the Rule of 55 down the road. You may want to consult a financial advisor to determine the most tax-efficient way to do this. And, of course, there’s the impact of healthcare. Make sure you have a solid plan for obtaining health insurance coverage after leaving your job. This could involve purchasing a plan through the ACA marketplace, enrolling in COBRA coverage, or exploring other options. Healthcare costs can be a significant expense in retirement, so it’s essential to have a plan in place.

Estate Planning Considerations

Estate planning is a crucial aspect of retirement planning, and it's especially important for those considering early retirement using the Rule of 55. Proper estate planning ensures that your assets are protected and distributed according to your wishes in the event of your death. It also helps to minimize potential estate taxes and probate fees.

One key aspect of estate planning is creating a will or trust. A will is a legal document that outlines how you want your assets to be distributed after your death. A trust, on the other hand, is a legal arrangement where you transfer ownership of your assets to a trustee, who manages them on behalf of your beneficiaries. Trusts can offer several advantages over wills, including avoiding probate and providing greater control over how your assets are distributed. Consider consulting with an estate planning attorney to determine the best option for your situation. Another important consideration is naming beneficiaries for your retirement accounts. This ensures that your retirement funds are passed on to your loved ones in a tax-efficient manner. Be sure to review your beneficiary designations regularly to ensure they are up-to-date and reflect your current wishes.

Fun Facts About the Rule of 55

Did you know that the Rule of 55 isn't just for those seeking early retirement by choice? It was initially designed as a safety net for workers who are involuntarily terminated from their jobs later in their careers. This means that if you're laid off or fired from your job during or after the year you turn 55, you can access your 401(k) funds penalty-free, even if you weren't planning on retiring early.

Another fun fact is that the Rule of 55 has been around for quite some time. It was first introduced as part of the Tax Reform Act of 1986, and it has been a valuable tool for early retirees ever since. Despite its long history, many people are still unaware of this provision, which highlights the importance of educating yourself about retirement planning strategies. And, while it might sound like the Rule of 55 allows you to withdraw unlimited funds from your 401(k) penalty-free, it’s important to remember that withdrawals are still subject to income tax. This can significantly impact your overall tax burden, so it's crucial to plan your withdrawals carefully and consult with a tax professional. It's a useful tool, but remember to keep in mind all of the implications of using it.

How to Strategically Plan with the Rule of 55

Strategic planning is the cornerstone of a successful early retirement using the Rule of 55. It's not enough to simply know the rule exists; you need to develop a comprehensive plan that addresses your financial needs, healthcare costs, and long-term retirement goals. One of the first steps in strategic planning is to accurately estimate your retirement expenses. This includes everything from housing and utilities to food, transportation, and healthcare. Be sure to factor in inflation and potential unexpected expenses.

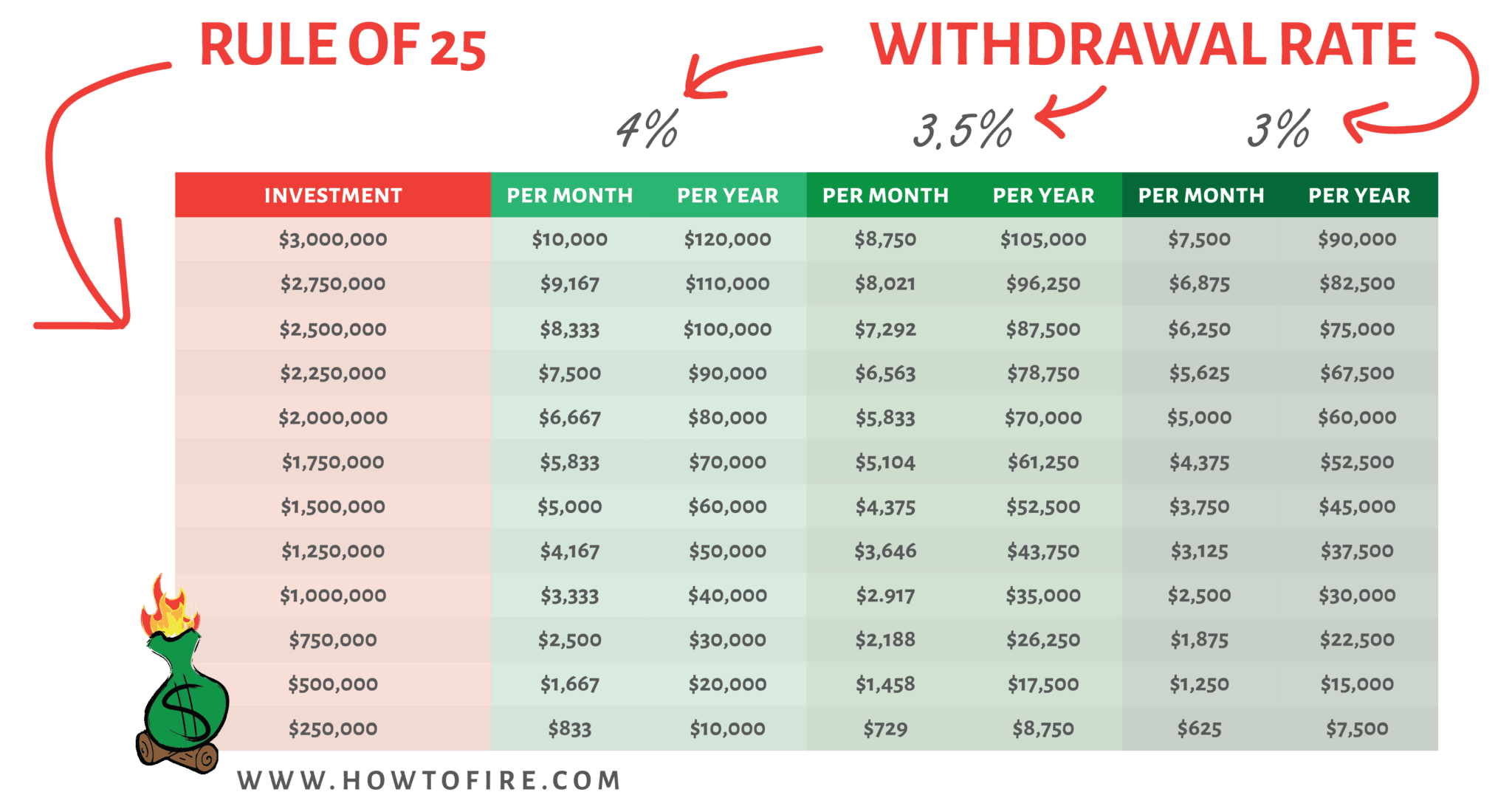

Next, you need to determine how much income you'll need to generate from your 401(k) and other sources to cover your expenses. This will help you determine a sustainable withdrawal rate that won't deplete your savings too quickly. Consider using a retirement calculator or working with a financial advisor to project your income needs and withdrawal strategy. Another important aspect of strategic planning is to consider the tax implications of your withdrawals. Withdrawals from your 401(k) are generally taxed as ordinary income, which can significantly impact your overall tax burden. You may be able to reduce your tax liability by spreading out your withdrawals over time or by considering Roth conversions. You should also remember to factor in the effect of inflation. It can erode the purchasing power of your savings over time. By taking a strategic approach, you can develop a retirement plan that aligns with your goals and provides you with the financial security you need to enjoy your early retirement.

What If You Don't Qualify for the Rule of 55?

Even if you don't qualify for the Rule of 55, don't despair! There are still other options available to access your retirement funds before age 59.5 without incurring the 10% early withdrawal penalty. One such option is the "substantially equal periodic payments" (SEPP) rule, also known as 72(t) distributions. This rule allows you to take a series of regular withdrawals from your IRA based on your life expectancy.

To qualify for SEPP distributions, you must follow a strict set of rules and calculations determined by the IRS. The withdrawals must be "substantially equal," meaning they must be calculated using one of three approved methods: the required minimum distribution method, the fixed amortization method, or the fixed annuitization method. The withdrawals must also be taken at least annually for a period of at least five years or until you reach age 59.5, whichever is longer. Another strategy is the Roth IRA Conversion Ladder. This involves converting traditional IRA funds to a Roth IRA, paying income taxes on the converted amounts, and then waiting five years before withdrawing the contributions penalty-free. This can be a tax-efficient way to access your retirement savings early, but it requires careful planning and execution. If those options do not appeal to you, you may consider using taxable brokerage accounts. These offer flexibility but lack the tax advantages of retirement accounts.

Listicle: Key Takeaways About the Rule of 55

Let's recap the most important things to remember about the Rule of 55:

- Eligibility: You must leave your job during or after the year you turn 55.

- Applies to Your Last Employer's Plan: The rule only applies to the 401(k) or 403(b) from the employer you most recently left.

- No Penalty, but Still Taxable: Withdrawals are free from the 10% penalty but are still subject to income tax.

- Strategic Planning is Key: Develop a comprehensive financial plan to ensure you don't outlive your savings.

- Consider Healthcare Costs: Factor in the cost of health insurance when planning your early retirement.

- Don't Roll Over Too Soon: Avoid rolling over your 401(k) to an IRA before utilizing the Rule of 55.

- Estate Planning Matters: Create a will or trust to protect your assets and ensure they are distributed according to your wishes.

- Explore Alternatives if You Don't Qualify: If you don't meet the Rule of 55 requirements, consider SEPP distributions or other strategies.

By following these tips, you can make informed decisions about whether the Rule of 55 is right for you and create a solid foundation for a financially secure and fulfilling early retirement. The path to FIRE is achievable with foresight and the right knowledge.

Question and Answer about Rule of 55

Here are some frequently asked questions about the Rule of 55:

Question 1: Does the Rule of 55 apply to my IRA?

Answer: No, the Rule of 55 only applies to 401(k) or 403(b) accounts from your last employer. Once you roll over those funds into an IRA, they are no longer eligible under this rule.

Question 2: What if I get a new job after retiring early and using the Rule of 55?

Answer: Getting a new job after taking distributions under the Rule of 55 does not affect your eligibility to continue taking penalty-free withdrawals from your previous employer's 401(k).

Question 3: Can I use the Rule of 55 if I'm self-employed?

Answer: The Rule of 55 typically applies to employees who separate from service. However, if you have a self-employed 401(k) (solo 401(k)), the rules may be different. Consult with a financial advisor to determine your eligibility.

Question 4: What happens if I violate the SEPP rules after starting 72(t) distributions?

Answer: If you violate the SEPP rules by modifying the distributions or stopping them before the required timeframe, you will be retroactively penalized for all distributions taken before age 59.5.

Conclusion of Rule of 55 for FIRE Movement: Access 401k Funds Before Age 59.5

The Rule of 55 is a powerful tool that can help you achieve your FIRE goals by providing early access to your 401k funds without penalty. By understanding the rules, planning strategically, and seeking professional advice, you can navigate the complexities of early retirement and create a financially secure future. Remember to carefully consider your financial needs, healthcare costs, and tax implications to ensure a smooth transition into early retirement. The FIRE movement is all about taking control of your financial destiny, and the Rule of 55 can be a valuable asset in achieving that goal.

Post a Comment