Self Employment Tax for FIRE Movement: What Side Hustlers Pay

So, you're chasing FIRE (Financial Independence, Retire Early) with a side hustle or two? That's fantastic! But before you start picturing yourself sipping margaritas on a beach, let's talk about something that often gets overlooked: self-employment tax. It's a crucial piece of the FIRE puzzle, and understanding it can save you from some unpleasant surprises down the road.

Many people dreaming of financial freedom focus intensely on increasing income and cutting expenses. While that's important, neglecting the tax implications of self-employment can significantly impact your progress. Ignoring this aspect can lead to underpayment penalties, unexpected tax bills, and a slower path to achieving your FIRE goals.

This post is designed to shed light on self-employment tax specifically for those pursuing FIRE through side hustles and entrepreneurial ventures. We'll break down what it is, how it works, what you can expect to pay, and how to minimize your tax burden legally, allowing you to keep more of your hard-earned money and accelerate your journey to financial independence.

In essence, this article provides a comprehensive guide to self-employment tax for individuals in the FIRE movement, particularly those earning income through side hustles. We will cover the calculation of self-employment tax, strategies for minimizing it, common misconceptions, record-keeping best practices, and the importance of understanding its impact on your overall FIRE plan. By mastering these concepts, side hustlers can optimize their finances and achieve financial independence sooner.

Decoding Self-Employment Tax: My Early Mistakes

When I first started freelancing, I was so excited about making extra money that I completely forgot about taxes. I was young and naive, I thought whatever I earned after deducting expenses was pure profit. It was a rude awakening when tax season rolled around, and I realized I owed a significant amount in self-employment tax. I had drastically underestimated how much I needed to set aside, resulting in a scramble to find the funds and a serious dent in my savings goal. It really brought home how important it is to factor self employment tax into the overall FIRE equation. Now I treat every dollar as a tax liability.

Self-employment tax primarily covers Social Security and Medicare taxes for individuals who work for themselves. When you're an employee, these taxes are split between you and your employer. But as a self-employed individual, you're responsible for paying both portions, which can feel like a significant chunk of your income. The current self-employment tax rate is 15.3% (12.4% for Social Security and

2.9% for Medicare) on the first $168,600 of self-employment income (for 2024). The Medicare portion applies to all self-employment income. It’s crucial to understand that this isin additionto your regular income tax. So, you're essentially paying both the employee and employer contributions to these crucial social safety nets. Recognizing and accounting for this early on is essential for FIRE enthusiasts who are relying on side hustles to reach their financial goals. It prevents unpleasant surprises, and facilitates proper budgeting and expense tracking.

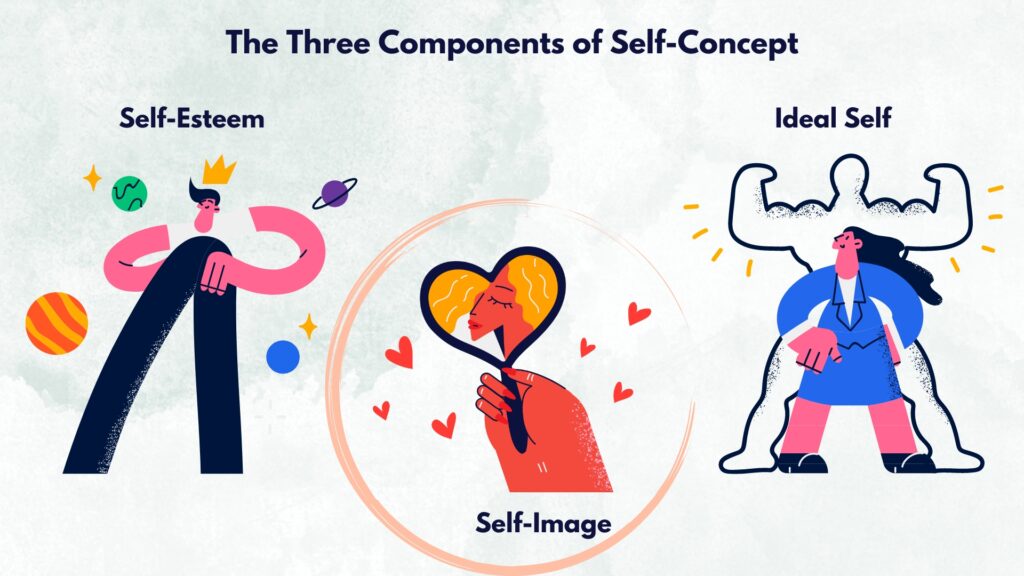

What Exactly Is Self-Employment Tax?

Self-employment tax is the tax you pay if you work for yourself. It's essentially the equivalent of the Social Security and Medicare taxes that are normally taken out of an employee's paycheck. When you work for someone else, your employer pays half of these taxes, and you pay the other half. But when you're self-employed, you're responsible for paying the entire amount.

Think of it this way: Social Security and Medicare taxes are mandatory contributions to these federal programs. These contributions fund retirement benefits, disability benefits, and healthcare for seniors and the disabled. When you're an employee, your employer withholds your share of these taxes and sends it to the government on your behalf. But as a self-employed individual, you're essentially acting as both the employer and the employee, so you're responsible for handling the entire payment yourself. The amount of self-employment tax you owe is based on your net earnings from self-employment, which is your gross income minus any business expenses. It's important to note that not all income is subject to self-employment tax. For example, investment income is generally not subject to self-employment tax. Furthermore, as mentioned above, there is a limit to the amount of income subject to Social Security tax. For 2024, that limit is $168,600. However, there is no limit on the amount of income subject to Medicare tax.

The History and Myths of Self-Employment Tax

The concept of self-employment tax has evolved significantly over time, rooted in the establishment of Social Security in 1935 and Medicare in 1965. Initially, these programs primarily focused on wage earners, leaving self-employed individuals outside the system. As the number of self-employed individuals grew, the need to incorporate them into the social safety net became apparent. This led to the enactment of self-employment tax, ensuring that those who work for themselves also contribute to and benefit from these vital programs.

One common myth is that self-employment tax is an unfair burden placed on entrepreneurs. While it's true that paying both the employer and employee portions can feel heavy, it's important to remember that these taxes fund essential social programs. Additionally, self-employed individuals are entitled to the same benefits as employees, including Social Security retirement benefits, disability benefits, and Medicare coverage. Another myth is that you only have to pay self-employment tax if your income exceeds a certain threshold. While it's true that you don't have to pay self-employment tax if your net earnings are less than $400, you're still required to report your self-employment income to the IRS, even if you don't owe any tax. The key is to understand the rules, take advantage of deductions, and plan accordingly to minimize the impact of self-employment tax on your FIRE journey. Proper planning can alleviate a good bit of stress.

The Hidden Secret: Deductions to Reduce Your Tax Burden

The biggest secret to managing self-employment tax isn't really a secret at all: it's leveraging deductions. Many self-employed individuals, especially those new to side hustles, miss out on valuable deductions that can significantly reduce their taxable income. This can then reduce your overall self-employment tax. The goal isn't tax evasion, it's tax avoidance!

One of the most significant deductions is the "one-half self-employment tax deduction." This allows you to deduct one-half of the self-employment tax you pay from your gross income. This effectively reduces your adjusted gross income (AGI), which can then lower your overall income tax liability. In addition to the self-employment tax deduction, you can also deduct various business expenses, such as office supplies, equipment, travel expenses, and home office expenses. If you use a portion of your home exclusively for business, you may be able to deduct a portion of your mortgage interest, rent, utilities, and other home-related expenses. It's crucial to keep accurate records of all your business expenses, as you'll need to substantiate these deductions when you file your taxes. Using accounting software or working with a tax professional can help you stay organized and ensure that you're taking advantage of all the deductions you're entitled to. Remember, every dollar you deduct is a dollar less that's subject to self-employment tax and income tax.

Recommendations for FIRE-Minded Side Hustlers

If you're pursuing FIRE through side hustles, my strongest recommendation is to treat your side hustle like a real business from day one. This means setting up a separate bank account, tracking all income and expenses meticulously, and consulting with a tax professional to ensure you're complying with all applicable tax laws. This is really important, don't get in trouble with the IRS!

Another recommendation is to pay your estimated taxes quarterly. Self-employment tax isn't automatically withheld from your income like it is when you're an employee. Instead, you're responsible for estimating how much you'll owe in self-employment tax and paying it to the IRS in four quarterly installments. This helps you avoid penalties for underpayment of taxes. You can use Form 1040-ES, Estimated Tax for Individuals, to calculate your estimated tax payments. Finally, don't be afraid to invest in your business. Investing in tools, equipment, or training can help you increase your income and reduce your tax burden. For example, if you're a freelance writer, you might invest in a grammar-checking software or a course on SEO writing. These expenses can be deducted from your income, reducing your taxable income and self-employment tax liability. Remember, smart investments in your business can pay off in the long run, both in terms of increased income and reduced taxes.

Staying Organized: Record-Keeping Best Practices

Detailed record-keeping is not just good practice; it's absolutely essential for managing self-employment tax effectively. The IRS requires you to keep accurate records of all your income and expenses, and these records will be crucial if you ever get audited. So how do you do this?

One of the best ways to stay organized is to use accounting software like Quick Books Self-Employed or Fresh Books. These programs can help you track your income and expenses, generate reports, and even estimate your taxes. If you prefer a more manual approach, you can use a spreadsheet or even a paper ledger. Whatever method you choose, be sure to keep detailed records of all your transactions, including the date, amount, and description of each transaction. It's also a good idea to keep copies of all your receipts, invoices, and other supporting documentation. These documents will be essential if you ever need to substantiate your deductions. Another helpful tip is to set aside a specific time each week or month to reconcile your records and ensure that everything is accurate. This will help you catch any errors or omissions early on, before they become bigger problems. Additionally, consider backing up your records regularly, either to a cloud-based service or an external hard drive. This will protect you from losing your data in the event of a computer crash or other disaster. Remember, the more organized you are, the easier it will be to manage your self-employment tax and maximize your deductions.

Tips and Tricks to Minimize Self-Employment Tax

Beyond the standard deductions, there are several strategic moves you can make to potentially lower your self-employment tax burden, but it all starts with good tax planning. The earlier you start planning, the better!

Consider structuring your business as an S corporation. This can allow you to pay yourself a reasonable salary, which is subject to employment taxes, while treating the remaining profits as distributions, which are not subject to self-employment tax. There are a few things to watch out for here, the IRS may try to audit you, so you need to make sure you're paying yourself an adequate salary. Another tip is to maximize your retirement contributions. Contributions to a SEP IRA or solo 401(k) are tax-deductible, which can reduce your taxable income and your self-employment tax liability. These are tax-deferred, meaning you'll pay income taxes when you withdraw in retirement. You can also take advantage of other tax-advantaged accounts, such as a health savings account (HSA). Contributions to an HSA are also tax-deductible, and the funds can be used to pay for qualified medical expenses. Furthermore, the money grows tax free, and withdrawals for medical expenses are also tax free. Finally, be sure to keep track of all your mileage for business-related travel. You can deduct the actual cost of your vehicle expenses or take the standard mileage rate, which is currently 67 cents per mile for 2024. Keeping a detailed mileage log can help you maximize this deduction and reduce your tax liability. With some planning, it is definitely possible to minimize your tax burden.

Understanding Qualified Business Income (QBI) Deduction

The Qualified Business Income (QBI) deduction, established by the Tax Cuts and Jobs Act of 2017, is another powerful tool for reducing your tax burden as a self-employed individual. This deduction allows eligible self-employed individuals, small business owners, and certain other taxpayers to deduct up to 20% of their qualified business income (QBI).

QBI is generally defined as the net amount of qualified items of income, gain, deduction, and loss from a qualified trade or business. It does not include certain items, such as capital gains or losses, interest income, and wage income. The QBI deduction is subject to certain limitations based on your taxable income. For 2024, the deduction is capped at 20% of your taxable income or 20% of your QBI, whichever is less. If your taxable income exceeds certain thresholds ($191,950 for single filers and $383,900 for married filing jointly), the deduction may be limited or phased out. However, even if your income exceeds these thresholds, you may still be able to claim a partial QBI deduction. To claim the QBI deduction, you'll need to complete Form 8995 or Form 8995-A and attach it to your tax return. It's important to consult with a tax professional to determine your eligibility for the QBI deduction and to ensure that you're claiming the correct amount. The QBI deduction can be a significant tax benefit for self-employed individuals, so it's worth exploring whether you qualify.

Fun Facts About Self-Employment Tax

Did you know that self-employment tax has been around since 1951? It was created to ensure that self-employed individuals contribute to Social Security and Medicare, just like employees. Before that, self-employed individuals were not covered by these programs!

Here's another fun fact: self-employment tax is calculated on Schedule SE (Form 1040) of your federal income tax return. This form helps you determine how much self-employment tax you owe based on your net earnings from self-employment. And here's a surprising fact: you can actually deduct one-half of your self-employment tax from your gross income. This deduction helps to offset the cost of self-employment tax and reduces your overall tax liability. Additionally, self-employment tax rates are not constant; they can change from year to year based on changes in the Social Security and Medicare tax rates. So, it's important to stay up-to-date on the latest tax laws and regulations to ensure that you're paying the correct amount of self-employment tax. Finally, self-employment tax applies to a wide range of self-employed individuals, including freelancers, independent contractors, small business owners, and even gig workers. If you earn income from self-employment, you're likely subject to self-employment tax. Learning about the history and various interesting facts about self-employment tax can help you appreciate its role in the U.S. tax system and its impact on your finances.

How to Pay Self-Employment Tax

Paying self-employment tax can seem daunting, but it's actually a straightforward process. The most common way to pay self-employment tax is through estimated tax payments. Since self-employment tax isn't automatically withheld from your income, you're responsible for estimating how much you'll owe and paying it to the IRS in four quarterly installments.

These quarterly payments are due on April 15, June 15, September 15, and January 15 of the following year (although these dates may be adjusted if they fall on a weekend or holiday). You can pay your estimated taxes online through the IRS website, by mail, or by phone. To pay online, you'll need to create an account on the IRS website and use the Electronic Federal Tax Payment System (EFTPS). This is the preferred method for most taxpayers, as it's convenient and secure. Alternatively, you can pay by mail by sending a check or money order to the IRS along with Form 1040-ES. Be sure to write your Social Security number, the tax year, and "Form 1040-ES" on your payment. Another option is to pay by phone using a credit card or debit card. However, the IRS charges a fee for this service. If you don't pay enough estimated taxes, you may be subject to penalties. To avoid penalties, it's important to accurately estimate your self-employment income and make timely payments. You can use Form 1040-ES to calculate your estimated tax payments or consult with a tax professional for assistance. Remember, paying your self-employment tax on time is crucial for avoiding penalties and maintaining good standing with the IRS.

What If I Don't Pay Self-Employment Tax?

Ignoring your self-employment tax obligations can have serious consequences. The IRS doesn't take kindly to unpaid taxes, and they have a range of penalties and enforcement actions they can take to collect what you owe. The most common penalty for not paying self-employment tax is the underpayment penalty. This penalty is assessed when you don't pay enough estimated taxes throughout the year.

The penalty is calculated based on the amount of the underpayment, the period of the underpayment, and the applicable interest rate. The interest rate is determined by the IRS and can fluctuate over time. In addition to the underpayment penalty, you may also be subject to other penalties, such as the failure-to-file penalty and the failure-to-pay penalty. The failure-to-file penalty is assessed if you don't file your tax return on time. The failure-to-pay penalty is assessed if you don't pay your taxes on time. These penalties can add up quickly and significantly increase your tax liability. If you're unable to pay your self-employment tax, it's important to contact the IRS as soon as possible to discuss your options. The IRS may be willing to work with you to set up a payment plan or offer other forms of relief. However, it's always best to pay your taxes on time to avoid penalties and interest. Ignoring your self-employment tax obligations can lead to wage garnishment, bank levies, and even criminal charges in extreme cases. So, it's crucial to take your self-employment tax obligations seriously and pay your taxes on time.

Listicle of Self-Employment Tax for FIRE Movement: What Side Hustlers Pay

Okay, let's break down the key takeaways about self-employment tax for FIRE-minded side hustlers into a handy list:

1.Know the Rate: Self-employment tax is currently

15.3% (12.4% for Social Security and

2.9% for Medicare) on the first $168,600 of self-employment income (for 2024), and Medicare portion apply to all self-employment income.

2.Quarterly Payments: Pay estimated taxes quarterly to avoid underpayment penalties.

3.Deductions are Key: Maximize deductions for business expenses, home office, and the one-half self-employment tax deduction.

4.Consider an S Corp: Explore structuring your business as an S corporation to potentially lower your tax burden.

5.Retirement Savings: Maximize contributions to tax-advantaged retirement accounts like SEP IRAs or solo 401(k)s.

6.Record Keeping: Maintain detailed records of all income and expenses.

7.Professional Help: Consult with a tax professional for personalized advice.

8.QBI Deduction: Investigate the Qualified Business Income (QBI) deduction.

9.Stay Updated: Keep abreast of changes in tax laws and regulations.

10.Don't Ignore It: Ignoring self-employment tax can lead to penalties and legal issues.

By following these tips, side hustlers can effectively manage their self-employment tax obligations and keep more of their hard-earned money, accelerating their journey to FIRE.

Question and Answer: Self-Employment Tax for FIRE Movement

Here are some common questions about self-employment tax, specifically geared towards those pursuing FIRE:

Q: How does self-employment tax impact my FIRE calculations?

A: Self-employment tax reduces the amount of income you have available to invest and save towards your FIRE goals. It's essential to factor it into your budget and savings projections to get an accurate picture of your progress.

Q: Can I deduct my health insurance premiums if I'm self-employed?

A: Yes, you can generally deduct the amount you paid in health insurance premiums for yourself, your spouse, and your dependents. This can be a significant deduction for self-employed individuals who are responsible for paying their own health insurance.

Q: What happens if I underestimate my self-employment income and underpay my estimated taxes?

A: You may be subject to an underpayment penalty. To avoid this, try to estimate your income as accurately as possible and make timely payments. You can also adjust your estimated tax payments throughout the year if your income changes.

Q: Is it worth it to pursue side hustles for FIRE, even with self-employment tax?

A: Absolutely! While self-employment tax is a real consideration, the increased income and potential for faster FIRE progress often outweigh the tax burden. By managing your taxes effectively and maximizing deductions, you can still significantly accelerate your journey to financial independence.

Conclusion of Self Employment Tax for FIRE Movement: What Side Hustlers Pay

Understanding and managing self-employment tax is vital for anyone pursuing FIRE through side hustles or entrepreneurial ventures. By grasping the fundamentals, maximizing deductions, and planning strategically, you can minimize your tax burden and keep more of your income working towards your financial goals. Remember, knowledge is power, and a proactive approach to self-employment tax will set you up for success on your FIRE journey.

Post a Comment