FIRE Movement Value Investing: Warren Buffett Strategies for Early Retirement

Imagine retiring decades before your peers, living off your investments, and spending your days pursuing your passions. It's not a pipe dream; it's the reality for those who embrace the FIRE movement and apply value investing principles championed by legendary investor Warren Buffett.

The road to financial independence can feel overwhelming. Many grapple with the sheer amount of information, the complex calculations, and the potential risks involved in the stock market. The fear of making the wrong investment decisions and derailing their early retirement plans keeps many from even starting the journey.

This blog post explores how you can leverage Warren Buffett's value investing strategies within the FIRE (Financial Independence, Retire Early) movement to build a solid financial foundation and achieve early retirement. We'll delve into the core principles, practical applications, and real-world examples to guide you on your path to financial freedom.

We've explored combining the FIRE movement with value investing principles, drawing inspiration from Warren Buffett's successful strategies. We've covered essential aspects like identifying undervalued assets, managing risk, and building a diversified portfolio for long-term growth, all geared toward achieving financial independence and early retirement. Ultimately, understanding and implementing these principles can empower you to take control of your financial future and retire on your own terms.

My Personal Journey with Value Investing and FIRE

My introduction to value investing wasn't through a textbook, but through a family hardship. During the 2008 financial crisis, my family's small business was nearly wiped out. Watching my parents struggle ignited a desire to understand how money works and how to protect it. I stumbled upon Warren Buffett's letters to shareholders and was immediately captivated by his clear, logical approach to investing. It wasn't about chasing quick gains, but about understanding the intrinsic value of a company and buying it at a discount. This resonated deeply with me, and I began applying these principles to my own savings. I started small, investing in companies I understood and believed in, focusing on long-term growth rather than short-term speculation.

Over time, I realized that value investing wasn't just about making money; it was about building a secure future. That's when I discovered the FIRE movement, and it all clicked into place. The FIRE movement, combined with value investing, provided a framework for achieving financial independence much earlier than the traditional retirement age. By living frugally, saving aggressively, and investing wisely in undervalued assets, I could accelerate my journey toward financial freedom. The key is to be patient, disciplined, and to constantly learn and adapt. The FIRE movement, combined with value investing, offers a powerful path to early retirement, but it requires commitment and a long-term perspective. Remember, the goal is not just to retire early, but to retire comfortably and securely, with enough passive income to support your desired lifestyle.

What is FIRE Movement Value Investing?

FIRE Movement Value Investing is a strategy that combines the principles of the Financial Independence, Retire Early (FIRE) movement with the value investing philosophy popularized by Warren Buffett. The FIRE movement emphasizes aggressive saving and investing to achieve financial independence and retire much earlier than traditional retirement age. Value investing, on the other hand, focuses on identifying undervalued assets – typically stocks – whose market price is significantly below their intrinsic value. The core idea behind FIRE Movement Value Investing is to leverage the power of compound interest by investing in undervalued companies and holding them for the long term, allowing them to grow and generate passive income. This approach aims to accelerate the path to financial independence and early retirement by maximizing returns while minimizing risk. Instead of blindly following market trends or chasing high-growth stocks, FIRE Movement Value Investing prioritizes careful analysis, patience, and a long-term perspective.

Think of it as building a fortress, brick by brick, with solid, reliable investments rather than constructing a house of cards with speculative bets. It's about finding companies with strong fundamentals, a competitive advantage, and a proven track record, and buying them when they are temporarily undervalued. The FIRE movement provides the framework for saving and investing aggressively, while value investing provides the methodology for choosing the right investments. When combined, they create a powerful synergy that can significantly increase your chances of achieving financial freedom and retiring early.

History and Myths of FIRE Movement Value Investing

While the term "FIRE Movement Value Investing" might seem relatively new, its roots run deep into the history of both value investing and the pursuit of financial independence. The seeds of value investing were sown by Benjamin Graham, Warren Buffett's mentor, who advocated for buying stocks of companies trading below their net asset value. The FIRE movement, in its modern form, emerged in the 1990s, fueled by blogs and online communities sharing strategies for aggressive saving and early retirement. The combination of these two approaches is a natural evolution, as value investing provides a disciplined and potentially high-yielding method for achieving the financial goals of the FIRE movement.

One common myth is that FIRE Movement Value Investing requires immense wealth to begin with. While a larger initial investment can certainly accelerate the process, it's important to remember that consistent saving and disciplined investing, even with smaller amounts, can yield significant results over time due to the power of compounding. Another myth is that it's a get-rich-quick scheme. Value investing, by its very nature, is a long-term strategy that requires patience and a willingness to weather market fluctuations. It's not about making a quick buck, but about building a solid financial foundation that can sustain you through early retirement. Finally, some believe that it's too complicated or time-consuming. While it does require some research and understanding of financial statements, there are plenty of resources available to learn the basics, and the time investment can be well worth it in the long run. Remember, the key is to start small, learn as you go, and stay committed to your goals.

Hidden Secrets of FIRE Movement Value Investing

One of the hidden secrets of FIRE Movement Value Investing lies in understanding the importance of emotional intelligence and behavioral finance. Value investing isn't just about analyzing numbers; it's about understanding your own biases and emotions and how they can impact your investment decisions. Fear and greed are powerful forces that can lead investors to make irrational choices, such as selling low during market downturns or chasing high-flying stocks that are already overvalued. By developing emotional intelligence and understanding behavioral finance principles, you can become a more disciplined and rational investor. Another secret is the power of continuous learning and adaptation. The market is constantly evolving, and what worked in the past may not work in the future. It's crucial to stay informed, read widely, and continuously learn about new industries, business models, and investment strategies. Finally, don't underestimate the importance of building a strong support network. Connecting with other value investors and FIRE enthusiasts can provide valuable insights, encouragement, and accountability. Sharing your experiences and learning from others can help you stay on track and avoid common pitfalls. The FIRE movement, combined with value investing, is not a solitary journey; it's a community of like-minded individuals working towards a common goal. By embracing these hidden secrets, you can significantly increase your chances of achieving financial independence and retiring early.

Recommendations for FIRE Movement Value Investing

If you're serious about pursuing FIRE Movement Value Investing, my top recommendation is to start with a solid foundation of financial literacy. Read books on value investing, behavioral finance, and personal finance. Familiarize yourself with financial statements, valuation techniques, and risk management principles. Warren Buffett's letters to shareholders are a great starting point, as they provide invaluable insights into his investment philosophy and decision-making process. Next, develop a clear financial plan that outlines your savings goals, investment strategy, and desired retirement lifestyle. This plan should be tailored to your individual circumstances, risk tolerance, and time horizon. It's also crucial to track your progress and make adjustments as needed. Another recommendation is to focus on building a diversified portfolio of undervalued companies across different industries and sectors. This will help to reduce your overall risk and improve your chances of long-term success. Don't put all your eggs in one basket, and be prepared to hold your investments for the long haul, even during market downturns. Finally, be patient, disciplined, and persistent. Value investing is not a get-rich-quick scheme, and it requires a long-term perspective. There will be times when your investments underperform, but it's important to stay focused on your goals and stick to your investment strategy. Remember, the key is to buy undervalued companies, hold them for the long term, and let the power of compounding work its magic.

Understanding Intrinsic Value in the Context of FIRE

Delving deeper into intrinsic value, within the FIRE movement, is paramount. Intrinsic value represents the true, inherent worth of a company, independent of its current market price. To calculate intrinsic value, you need to analyze a company's financial statements, including its revenue, earnings, assets, and liabilities. You also need to consider its competitive advantages, management team, and industry outlook. Warren Buffett emphasizes the importance of understanding a company's business model and its ability to generate consistent profits over the long term. This is particularly crucial for FIRE, because you are aiming for your investments to sustain you for decades. Once you have a good understanding of a company's fundamentals, you can use various valuation techniques, such as discounted cash flow analysis or relative valuation, to estimate its intrinsic value. If the market price is significantly below your estimate of intrinsic value, then the company may be undervalued and a potentially good investment.

However, it's important to remember that intrinsic value is not an exact science, and it involves some degree of estimation and judgment. It's also important to be patient and wait for the right opportunities. Don't feel pressured to invest in something just because it seems cheap. Only invest in companies that you understand and believe in, and that are trading at a significant discount to their intrinsic value. By focusing on intrinsic value, you can avoid the pitfalls of chasing speculative investments and build a solid portfolio of undervalued companies that can generate long-term wealth and help you achieve your FIRE goals. Remember, the goal is not just to retire early, but to retire comfortably and securely, with enough passive income to support your desired lifestyle.

Tips for Implementing FIRE Movement Value Investing

One of the most crucial tips for successful FIRE Movement Value Investing is to live below your means. The FIRE movement is built on the foundation of aggressive saving, and the more you save, the faster you'll reach your financial independence goal. Track your expenses, identify areas where you can cut back, and make a conscious effort to save a significant portion of your income. Another important tip is to automate your savings and investments. Set up automatic transfers from your checking account to your investment account each month, so you don't have to think about it. This will help you stay consistent with your savings and investment goals, even when you're feeling tempted to spend more. Diversification is also key. Don't put all your eggs in one basket. Spread your investments across different industries, sectors, and asset classes to reduce your overall risk.

Consider investing in a mix of stocks, bonds, and real estate, depending on your risk tolerance and time horizon. Furthermore, regularly review your portfolio and rebalance as needed. Market conditions change, and your portfolio may become overweighted in certain areas. Rebalancing involves selling some of your winning investments and buying more of your losing investments to maintain your desired asset allocation. Finally, stay informed and keep learning. The world of investing is constantly evolving, and it's important to stay up-to-date on the latest trends and developments. Read books, articles, and blogs on value investing and personal finance, and attend conferences and workshops to network with other investors. The more you learn, the better equipped you'll be to make informed investment decisions and achieve your FIRE goals.

Analyzing Financial Statements for Value Investing

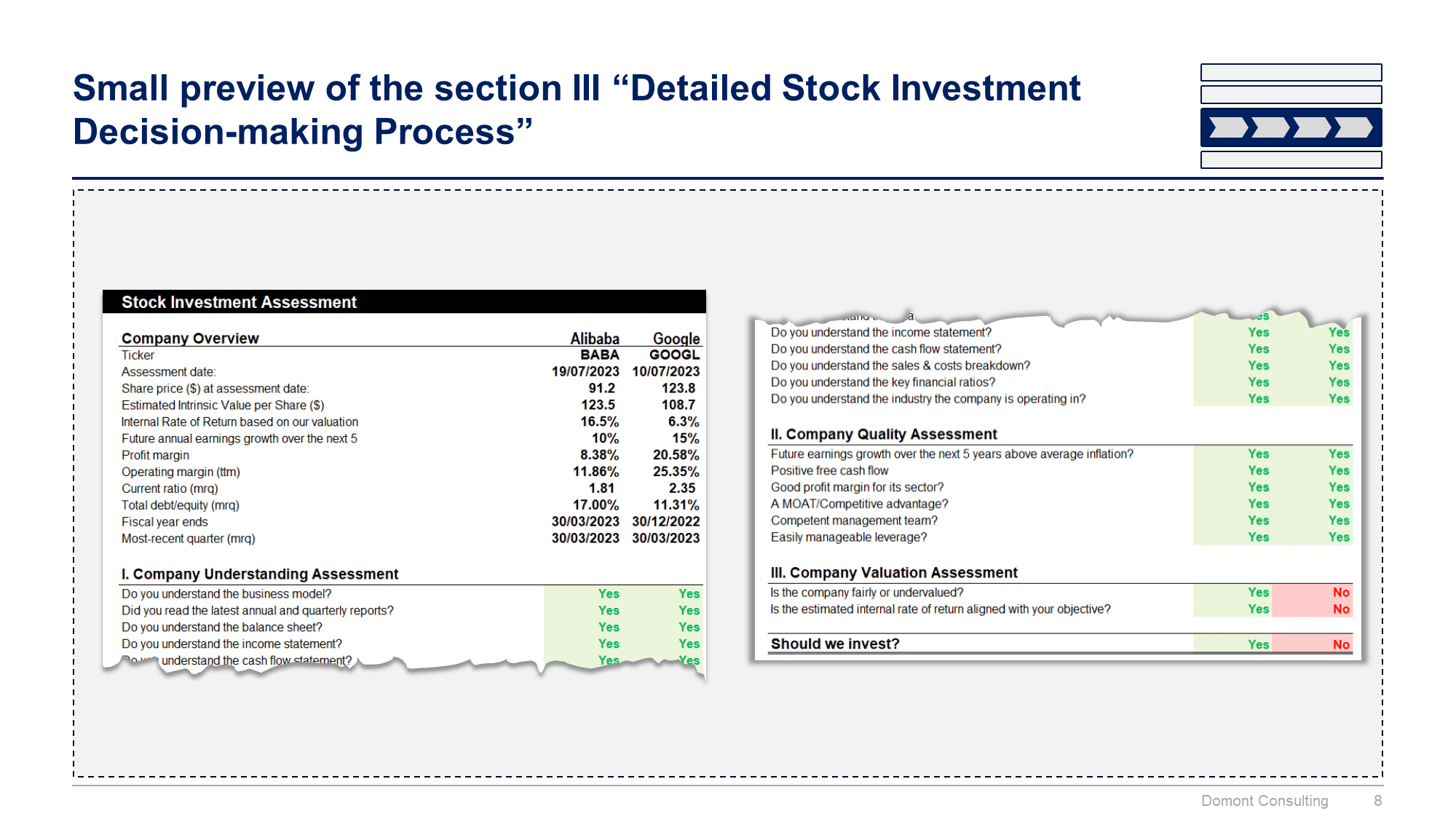

Analyzing financial statements is a critical skill for any value investor, and it's essential for successfully implementing FIRE Movement Value Investing. The three main financial statements are the income statement, the balance sheet, and the cash flow statement. The income statement shows a company's revenues, expenses, and profits over a period of time. It can help you assess a company's profitability and growth potential. The balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It can help you assess a company's financial health and solvency. The cash flow statement tracks the movement of cash into and out of a company over a period of time. It can help you assess a company's ability to generate cash and meet its financial obligations.

When analyzing financial statements, pay attention to key ratios and metrics, such as the price-to-earnings (P/E) ratio, the price-to-book (P/B) ratio, the debt-to-equity (D/E) ratio, and the return on equity (ROE). These ratios can provide valuable insights into a company's valuation, financial health, and profitability. It's also important to compare a company's financial performance to its peers and to its own historical performance. This can help you identify trends and assess whether a company is improving or deteriorating over time. Remember, the goal of financial statement analysis is to determine whether a company is undervalued and whether it has the potential to generate long-term wealth. By mastering this skill, you can significantly improve your chances of success in FIRE Movement Value Investing.

Fun Facts of FIRE Movement Value Investing

Did you know that Warren Buffett started investing at the age of 11, buying shares of Cities Service Preferred stock? This highlights the importance of starting early and the power of compounding over time. Another fun fact is that Buffett still lives in the same house he bought in 1958 for $31,500. This demonstrates his frugality and his focus on long-term value rather than material possessions. In the context of FIRE, this reinforces the idea that it's not about depriving yourself, but about making conscious choices and prioritizing your financial goals. Furthermore, the FIRE movement has gained significant traction in recent years, with online communities and blogs dedicated to sharing strategies and tips for achieving financial independence. This demonstrates the growing interest in early retirement and the increasing accessibility of information and resources for aspiring FIRE enthusiasts. Value investing and the FIRE movement are not just about numbers; they are about creating a lifestyle that aligns with your values and priorities.

The FIRE movement has its own unique slang and jargon. Terms like "lean FIRE" and "fat FIRE" describe different approaches to early retirement, depending on the level of frugality and spending desired. Understanding these terms can help you connect with other FIRE enthusiasts and learn from their experiences. Finally, many people who achieve FIRE don't actually stop working. They often pursue passion projects, start businesses, or engage in volunteer work. This highlights the fact that FIRE is not just about escaping work; it's about gaining the freedom and flexibility to pursue what truly matters to you. It’s not simply about saving all your money only to sit at home.

How to Start FIRE Movement Value Investing

Getting started with FIRE Movement Value Investing doesn't have to be complicated. The first step is to assess your current financial situation. Calculate your net worth, track your income and expenses, and create a budget. This will give you a clear picture of where you stand and how much you need to save and invest to reach your FIRE goals. Next, set clear and realistic financial goals. Determine your desired retirement age and your estimated expenses in retirement. This will help you calculate your FIRE number – the amount of money you need to have saved and invested to generate enough passive income to cover your expenses. Once you have a clear understanding of your financial situation and your goals, you can start developing your investment strategy. Focus on learning the basics of value investing and identifying undervalued companies. Read books, articles, and blogs on value investing, and consider taking online courses or attending workshops.

Start small and gradually increase your investment amount as you become more comfortable and confident. You don't need to invest a lot of money to get started. Even small amounts can grow significantly over time due to the power of compounding. Also, be patient and disciplined. Value investing is not a get-rich-quick scheme, and it requires a long-term perspective. There will be times when your investments underperform, but it's important to stay focused on your goals and stick to your investment strategy. Finally, seek out mentors and connect with other FIRE enthusiasts. Learning from others can provide valuable insights, encouragement, and accountability. Join online communities, attend meetups, and connect with experienced investors who can guide you on your journey. Remember, the key to success is to start, stay consistent, and never stop learning.

What if FIRE Movement Value Investing Fails?

It's important to consider the potential risks and challenges associated with FIRE Movement Value Investing, and to have a plan in place in case things don't go as planned. One potential risk is that your investments may not perform as expected. Market downturns, economic recessions, and unexpected company-specific events can all negatively impact your portfolio. To mitigate this risk, it's important to diversify your investments, maintain a long-term perspective, and be prepared to weather market fluctuations. Another challenge is that your expenses in retirement may be higher than you anticipated. Healthcare costs, inflation, and unexpected emergencies can all strain your finances. To address this, it's important to factor in a margin of safety when calculating your FIRE number, and to have a plan for managing your expenses in retirement. You also need to be prepared to adjust your lifestyle if necessary. If your investments don't generate enough passive income to cover your expenses, you may need to downsize your home, cut back on discretionary spending, or find a part-time job.

It's also important to consider the emotional and psychological challenges of early retirement. Some people may struggle with a lack of purpose or structure in their lives after leaving the workforce. To address this, it's important to have a plan for how you'll spend your time in retirement, whether it's pursuing passion projects, volunteering, or traveling. Furthermore, it's important to stay connected with friends and family and to maintain a healthy lifestyle. Finally, it's important to have a backup plan in case your FIRE plan fails. This could involve returning to the workforce, delaying your retirement, or seeking financial assistance from family or friends. Remember, FIRE is not an all-or-nothing proposition. It's a journey, and it's important to be flexible and adaptable along the way. It's about making adjustments, learning from your mistakes, and continuing to adapt as your situation changes. A lot of people assume it is and feel despair and grief if things don’t go according to plan.

Listicle of FIRE Movement Value Investing

Here's a listicle of key takeaways for implementing FIRE Movement Value Investing:

1.Start Early: The earlier you start, the more time your investments have to grow.

2.Live Below Your Means: Aggressively save and invest a significant portion of your income.

3.Understand Value Investing: Learn the principles of value investing and how to identify undervalued companies.

4.Analyze Financial Statements: Develop the ability to read and interpret financial statements.

5.Diversify Your Portfolio: Spread your investments across different industries, sectors, and asset classes.

6.Maintain a Long-Term Perspective: Value investing is a long-term strategy that requires patience and discipline.

7.Be Patient: Wait for the right opportunities and don't feel pressured to invest in overvalued companies.

8.Manage Risk: Understand your risk tolerance and invest accordingly.

9.Stay Informed: Keep learning about value investing and personal finance.

10.Seek Mentorship: Connect with experienced investors and learn from their experiences.

11.Automate Your Savings and Investments: Set up automatic transfers to your investment account.

12.Track Your Progress: Monitor your net worth and investment returns regularly.

13.Rebalance Your Portfolio: Adjust your asset allocation as needed to maintain your desired risk profile.

14.Stay Flexible: Be prepared to adjust your FIRE plan as your circumstances change.

15.Enjoy the Journey: FIRE is not just about reaching a destination; it's about the journey itself.

Question and Answer about FIRE Movement Value Investing

Q: Is FIRE Movement Value Investing only for the wealthy?

A: No, FIRE Movement Value Investing is for anyone who is willing to save aggressively and invest wisely. While a larger initial investment can accelerate the process, even small amounts can grow significantly over time due to the power of compounding.Q:How much money do I need to retire early using value investing?

A: The amount of money you need depends on your desired lifestyle and expenses in retirement. A common rule of thumb is the "4% rule," which suggests that you can withdraw 4% of your portfolio each year without running out of money. To calculate your FIRE number, multiply your annual expenses in retirement by 25.Q: What are the biggest risks of FIRE Movement Value Investing?

A: The biggest risks include market downturns, unexpected expenses in retirement, and the emotional challenges of early retirement. To mitigate these risks, it's important to diversify your investments, factor in a margin of safety when calculating your FIRE number, and have a plan for how you'll spend your time in retirement.Q:How long does it take to achieve FIRE using value investing?

A: The time it takes to achieve FIRE depends on your savings rate, investment returns, and desired lifestyle. Some people can achieve FIRE in as little as 10 years, while others may take 20 years or more. The key is to stay consistent with your savings and investment goals, and to be patient and disciplined.

Conclusion of FIRE Movement Value Investing

FIRE Movement Value Investing offers a compelling path to financial freedom and early retirement, blending the aggressive savings of the FIRE movement with the disciplined investment approach of value investing. By understanding and implementing these principles, individuals can take control of their financial futures, build a solid foundation for long-term wealth, and retire on their own terms. The journey requires commitment, patience, and a willingness to learn, but the rewards of financial independence and the freedom to pursue your passions are well worth the effort. Remember to start early, stay consistent, and never stop learning.

Post a Comment