Free FIRE Movement Budget Template: Track Your Path to Financial Independence

Dreaming of early retirement? Imagine a life where work is optional, where your time is truly your own. The FIRE movement, or Financial Independence, Retire Early, is a lifestyle dedicated to achieving just that. But how do you navigate this path, especially when it comes to managing your finances? That's where a budget template comes in!

The road to financial independence can feel overwhelming. Juggling spreadsheets, calculating savings rates, and projecting future expenses can quickly become a confusing and time-consuming ordeal. Many aspiring FIRE enthusiasts find themselves lost in a sea of numbers, unsure if they're truly on track to reach their goals. Without a clear financial roadmap, it's easy to lose motivation and feel like early retirement is just a distant fantasy.

This blog post is for anyone who wants to take control of their finances and embark on the journey to FIRE with confidence. We'll introduce you to a powerful tool: a free FIRE movement budget template designed to simplify your financial planning and help you track your progress toward financial independence. Get ready to ditch the overwhelm and embrace a clear, actionable plan for your early retirement dreams!

This guide will walk you through everything you need to know about using a FIRE movement budget template. We'll explore its key features, discuss its benefits, and offer practical tips to help you maximize its effectiveness. By the end, you'll have a clear understanding of how this template can empower you to take charge of your financial future and accelerate your journey to FIRE. Keywords: FIRE movement, financial independence, retire early, budget template, financial planning, savings rate, expense tracking, early retirement.

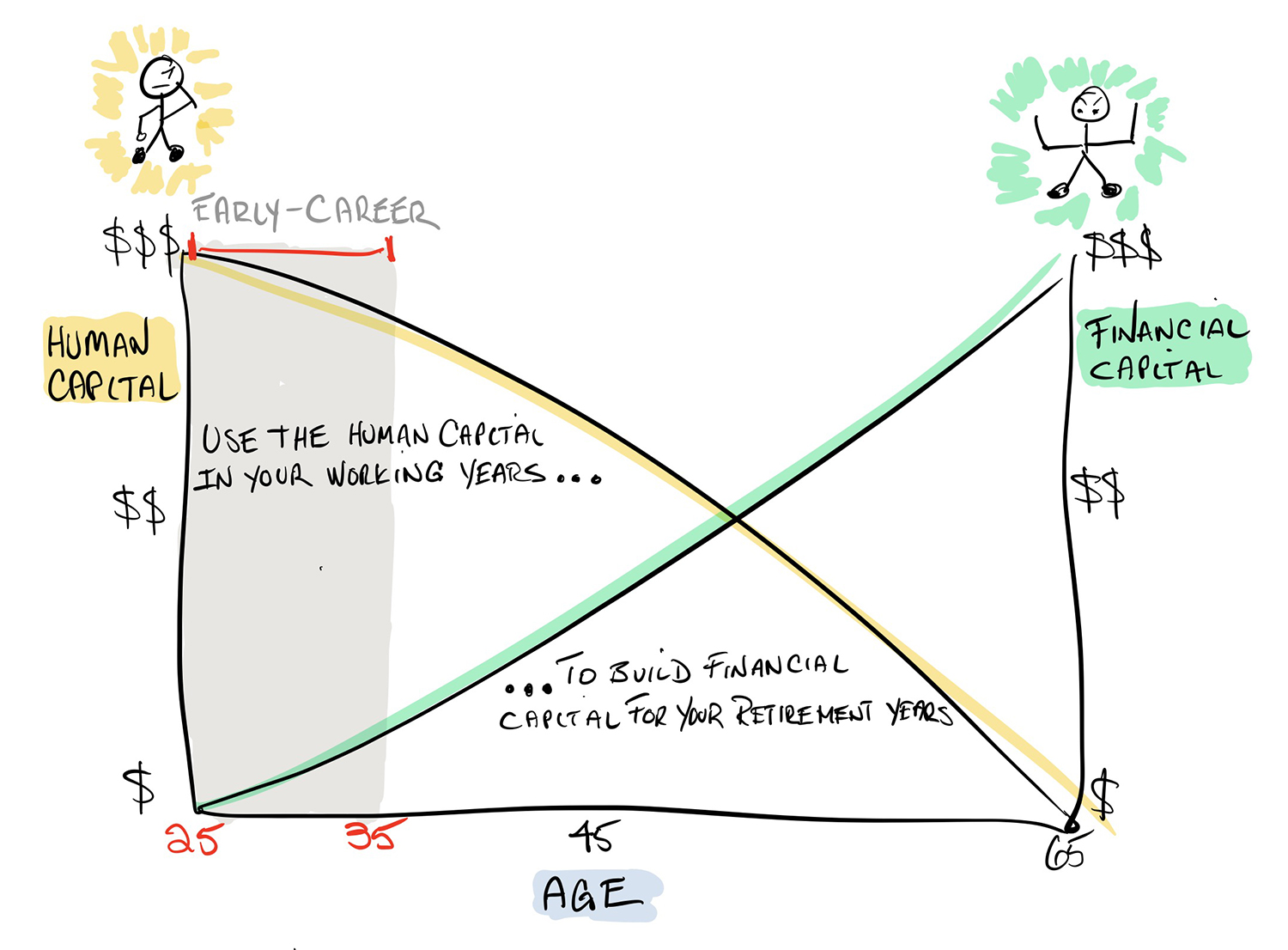

Understanding Your Financial Landscape

My journey toward financial independence started with a stark realization: I had no real clue where my money was going. I was saving, yes, but without a clear plan or a detailed understanding of my expenses. It felt like I was wandering in the dark, hoping to stumble upon financial freedom someday. The turning point came when I decided to meticulously track every penny I spent for a month. It was eye-opening to see how much I was frittering away on unnecessary things – daily coffees, impulse buys, and subscriptions I barely used. This exercise highlighted the urgent need for a budget.

A FIRE movement budget template provides that clarity and structure. It's not just about limiting spending; it's about understanding your financial landscape, identifying areas where you can optimize your savings, and projecting your future financial needs with greater accuracy. By tracking your income, expenses, assets, and liabilities, you gain a holistic view of your financial health. This empowers you to make informed decisions about your spending, investments, and overall financial strategy. You can pinpoint areas where you can cut back on expenses without sacrificing your quality of life, and you can identify opportunities to increase your income or optimize your investments. The budget template becomes your personal financial compass, guiding you toward your FIRE goals with confidence.

What is a FIRE Movement Budget Template?

A FIRE Movement Budget Template is essentially a pre-designed spreadsheet or digital tool that helps you track your income, expenses, savings, and investments, all tailored to the specific needs of someone pursuing financial independence and early retirement. Unlike a generic budgeting tool, a FIRE template focuses on key metrics relevant to the FIRE movement, such as your savings rate, your projected retirement age, and your estimated investment growth. It often includes features like a "safe withdrawal rate" calculator to help you determine how much you can safely withdraw from your investments each year without depleting your portfolio.

The template allows you to categorize your income streams (salary, side hustles, investment income), track your various expenses (housing, transportation, food, entertainment), and monitor the growth of your assets (stocks, bonds, real estate). It also typically includes charts and graphs that visualize your progress toward your FIRE goals, making it easier to stay motivated and on track. By providing a clear and organized framework for managing your finances, a FIRE movement budget template eliminates the guesswork and helps you make informed decisions that will accelerate your journey to financial independence. It becomes your central hub for all things financial, giving you a comprehensive overview of your current situation and a roadmap for your future success.

The History and Myth of FIRE Budgeting

The FIRE movement itself has roots in the late 20th century, with figures like Vicki Robin and Joe Dominguez, authors of "Your Money or Your Life," laying the groundwork for the principles of frugality and financial independence. However, the specific concept of a "FIRE movement budget template" is a more recent development, emerging as digital tools and spreadsheets became more accessible and user-friendly. Initially, FIRE enthusiasts relied on generic budgeting tools or created their own custom spreadsheets to track their progress. As the movement gained popularity, however, the demand for specialized templates grew, leading to the creation of various pre-designed tools specifically tailored to the needs of FIRE seekers.

One myth surrounding FIRE budgeting is that it requires extreme frugality and deprivation. While some FIRE strategies do involve aggressive saving and expense cutting, this is not always the case. The beauty of the FIRE movement is that it allows for a personalized approach, where individuals can tailor their strategies to their own values and priorities. A good budget template can help you identify areas where you can save money without sacrificing your quality of life. It's about making conscious choices about your spending, rather than simply depriving yourself of things you enjoy. Another myth is that you need a high income to achieve FIRE. While a higher income certainly makes it easier, it's not the only factor. A high savings rate, coupled with smart investing and disciplined budgeting, can enable individuals with moderate incomes to achieve financial independence much sooner than they might think.

Hidden Secrets of the FIRE Budget

One of the hidden secrets of a truly effective FIRE budget template lies in its ability to reveal subtle spending patterns that you might otherwise overlook. We often focus on the big-ticket items – rent, car payments, travel – but it's the small, recurring expenses that can really add up over time. Things like daily coffees, subscription services, and impulse purchases can silently erode your savings without you even realizing it. A well-designed budget template will force you to confront these hidden expenses and make conscious decisions about whether they align with your FIRE goals.

Another secret is the power of automation. Once you've set up your budget template, you can automate many of the tasks involved in tracking your income and expenses. You can link your bank accounts and credit cards to the template, so that transactions are automatically imported and categorized. This saves you time and effort, and it also reduces the risk of errors. Furthermore, a good FIRE budget template will help you project your future financial needs with greater accuracy. By factoring in inflation, investment growth, and potential changes in your income and expenses, you can create a more realistic roadmap for achieving financial independence. This allows you to adjust your savings rate and investment strategy as needed, to stay on track toward your goals. Finally, the most important secret is that the best budget is the one you actually use. It's not about finding the perfect template; it's about finding a template that works for you and incorporating it into your daily routine.

Recommendations for Your FIRE Journey

My top recommendation is to start simple. Don't get bogged down in complex features or overly detailed categories. Begin with a basic template that tracks your income, expenses, and savings rate. As you become more comfortable with the process, you can gradually add more features and customizations. There are countless free FIRE movement budget templates available online. Look for one that is user-friendly and visually appealing. A template that is easy to navigate and understand will make the budgeting process much less daunting. I would suggest looking at templates offered in Google Sheets or Microsoft Excel, as these programs are usually pretty accessible.

Another key recommendation is to regularly review and adjust your budget. Your financial situation is likely to change over time, so it's important to update your budget to reflect those changes. Review your budget at least once a month, and make adjustments as needed. Consider using a budgeting app in conjunction with your template. Many budgeting apps can automatically track your spending and categorize your transactions, making it easier to stay on top of your finances. I highly recommend using the 4% rule to determine when you can retire. This is a general rule of thumb and may not apply to everyone. It's important to consult with a financial advisor to determine what is best for you. Finally, don't be afraid to experiment with different budgeting strategies to find what works best for you. There is no one-size-fits-all approach to FIRE budgeting. The key is to find a system that is sustainable and that helps you stay motivated toward your goals.

Key Features of a FIRE Budget Template

A comprehensive FIRE budget template will include several essential features that set it apart from a basic budgeting tool. Firstly, it should have robust income tracking capabilities, allowing you to categorize income from various sources like your primary job, side hustles, investments, and passive income streams. This provides a clear picture of your overall earning potential and helps you identify opportunities to increase your income. Secondly, a FIRE template needs detailed expense tracking functionality, enabling you to categorize your spending into broad categories like housing, transportation, food, and entertainment, as well as more granular subcategories.

This level of detail helps you pinpoint areas where you can cut back on expenses and optimize your savings rate. Thirdly, the template should include a savings rate calculator, which automatically calculates your savings rate based on your income and expenses. Tracking your savings rate is crucial in the FIRE movement, as it directly impacts how quickly you can achieve financial independence. Fourthly, a FIRE template should incorporate investment tracking features, allowing you to monitor the performance of your investment portfolio and project its future growth. This will help you estimate how much money you will have available when you retire. Finally, the template should include a retirement projection calculator, which estimates how long it will take you to reach your FIRE goals based on your current savings rate, investment growth, and projected expenses in retirement. This provides a clear timeline for your FIRE journey and helps you stay motivated along the way.

Tips for Maximizing Your Budget Template

One of the most important tips for maximizing your FIRE movement budget template is to be consistent. Track your income and expenses religiously, even if it feels tedious at times. The more data you have, the more accurate your projections will be, and the better equipped you'll be to make informed financial decisions. Another key tip is to regularly review and analyze your budget. Don't just passively track your spending; take the time to understand where your money is going and identify areas where you can improve. Look for trends in your spending habits and ask yourself if your expenses align with your values and your FIRE goals.

Consider setting specific, measurable, achievable, relevant, and time-bound (SMART) goals for your savings rate and expenses. For example, instead of simply aiming to "save more money," set a goal to increase your savings rate by 2% each quarter. Another valuable tip is to use your budget template to forecast your future expenses. Think about potential changes in your life, such as starting a family, buying a home, or changing jobs, and factor those into your projections. This will help you prepare for unexpected expenses and ensure that you stay on track toward your FIRE goals. It is also important to be honest with yourself about your spending habits. It can be tempting to fudge the numbers to make your budget look better, but this will ultimately undermine your efforts. Finally, remember that your budget is a tool to help you achieve your goals, not a rigid set of rules to follow. Be flexible and willing to adjust your budget as needed to accommodate changing circumstances.

Common Mistakes to Avoid

One common mistake is failing to track all of your expenses. Many people only track their major expenses, like rent and car payments, but they neglect to track their smaller expenses, like daily coffees and subscription services. These smaller expenses can add up quickly, and if you're not tracking them, you'll be missing a significant piece of the puzzle. Another mistake is being too restrictive with your budget. While it's important to be mindful of your spending, it's also important to allow yourself some flexibility. If you try to cut out all of the things you enjoy, you're likely to get burned out and give up on your budget altogether.

Another mistake to avoid is not reviewing your budget regularly. Your financial situation is constantly changing, so it's important to review your budget on a regular basis to make sure it's still accurate and relevant. Many people don't take the time to update their budget, which leads to them being inaccurate. Another common mistake is not setting clear financial goals. What are you saving for? When do you want to retire? Without clear goals, it's difficult to stay motivated and on track with your budget. It is also common to not automate savings. If you do not automate, you may forget to do it! Finally, comparing your financial journey to others is detrimental. Everyone's financial situation is different, so don't compare yourself to others. Focus on your own goals and your own progress.

Fun Facts About FIRE Budgeting

Did you know that the 4% rule, a cornerstone of the FIRE movement, was originally based on research conducted in the 1990s by financial advisor William Bengen? Bengen's research analyzed historical stock market data to determine the maximum percentage of a retirement portfolio that could be safely withdrawn each year without running out of money over a 30-year period. Another fun fact is that the FIRE movement has spawned a variety of sub-movements, each with its own unique approach to achieving financial independence. For example, there's Lean FIRE, which emphasizes extreme frugality and a minimalist lifestyle. Then there's Fat FIRE, which focuses on achieving a higher level of wealth to support a more luxurious retirement.

Another interesting fact is that the FIRE movement is not just for young people. While many FIRE enthusiasts are in their 20s and 30s, there are also many older individuals who are pursuing financial independence as a way to escape the traditional retirement age. The FIRE movement has gained significant traction in recent years, thanks to the rise of online communities and personal finance blogs. These platforms provide a space for FIRE enthusiasts to share their experiences, offer advice, and support each other on their journeys. One of the biggest misconceptions about FIRE is that it's all about deprivation and sacrifice. While frugality is certainly a key element of the FIRE movement, it's not about depriving yourself of everything you enjoy. It's about making conscious choices about your spending and aligning your financial resources with your values and priorities.

How to Create Your Own FIRE Budget Template

Creating your own FIRE budget template can be a rewarding experience, allowing you to tailor it to your specific needs and preferences. Start by choosing a tool that you're comfortable with, such as Microsoft Excel, Google Sheets, or a dedicated budgeting app. Begin by outlining the key sections of your template: income, expenses, assets, and liabilities. Within each section, create detailed categories and subcategories to track your finances with precision. For example, under "income," you might have categories for salary, side hustle income, investment income, and rental income.

Under "expenses," you might have categories for housing, transportation, food, entertainment, and debt payments. Next, create formulas to automate calculations, such as your savings rate, your projected retirement age, and your estimated investment growth. This will save you time and effort in the long run. Consider adding charts and graphs to visualize your progress toward your FIRE goals. This can help you stay motivated and on track. Don't be afraid to experiment with different features and customizations to find what works best for you. There are countless templates available online that you can use as inspiration. Once you've created your template, be sure to test it thoroughly to make sure it's working correctly. Enter some sample data and see if the calculations are accurate. Finally, remember that your budget template is a living document. Be prepared to update it regularly as your financial situation changes.

What If You Deviate From Your FIRE Budget?

It's perfectly normal to deviate from your FIRE budget from time to time. Life happens, and unexpected expenses can arise. The key is not to beat yourself up about it, but rather to learn from the experience and get back on track as quickly as possible. Start by analyzing why you deviated from your budget. Was it due to an unexpected expense? Or did you simply overspend in a particular category? Once you understand the reason, you can take steps to prevent it from happening again. If it was due to an unexpected expense, consider building a larger emergency fund to cushion future setbacks.

If you simply overspent, try to identify the triggers that led to your overspending and develop strategies to avoid them in the future. Perhaps you need to limit your exposure to tempting situations, such as online shopping or eating out. It's also important to remember that your budget is a tool to help you achieve your goals, not a rigid set of rules to follow. Be flexible and willing to adjust your budget as needed to accommodate changing circumstances. If you consistently find yourself deviating from your budget in a particular area, it may be a sign that your budget is not realistic or sustainable. Consider adjusting your goals or finding ways to reduce your expenses in that area. Finally, don't be afraid to seek support from other FIRE enthusiasts. Share your experiences with others and learn from their successes and failures.

Top 5 Things to Track in Your FIRE Budget Template (Listicle)

1. Income: Track all sources of income, including salary, side hustles, investments, and rental income. This provides a clear picture of your overall earning potential.

2. Expenses: Categorize your expenses into broad categories like housing, transportation, food, and entertainment, as well as more granular subcategories. This helps you pinpoint areas where you can cut back on spending.

3. Savings Rate: Calculate your savings rate based on your income and expenses. This is a crucial metric for tracking your progress toward financial independence.

4. Investments: Monitor the performance of your investment portfolio and project its future growth. This will help you estimate how much money you will have available when you retire.

5. Net Worth: Track your net worth, which is the difference between your assets and your liabilities. This is a comprehensive measure of your overall financial health.

Tracking these five key metrics in your FIRE budget template will give you a clear understanding of your financial situation and help you stay on track toward your goals. Remember to regularly review and analyze your budget to identify areas where you can improve. By consistently tracking your income, expenses, savings rate, investments, and net worth, you'll be well on your way to achieving financial independence and early retirement.

Question and Answer on FIRE Movement Budget Template

Question 1: What is the most important thing to track in a FIRE budget template? Answer: While all aspects of a FIRE budget template are important, tracking your savings rate is arguably the most crucial. Your savings rate directly impacts how quickly you can achieve financial independence. Question 2: How often should I review my FIRE budget template? Answer: You should review your budget at least once a month, and more frequently if your financial situation changes. Regular review allows you to identify areas where you can improve and make adjustments as needed. Question 3: What if I don't have a lot of money to save? Answer: Even if you don't have a lot of money to save, you can still make progress toward FIRE. Focus on increasing your income, reducing your expenses, and making smart investment decisions. Question 4: Is FIRE budgeting only for people with high incomes? Answer: No, FIRE budgeting is not just for people with high incomes. While a higher income certainly makes it easier, individuals with moderate incomes can also achieve financial independence through disciplined budgeting and saving.

Conclusion of Free FIRE Movement Budget Template: Track Your Path to Financial Independence

A free FIRE movement budget template is an invaluable tool for anyone seeking financial independence and early retirement. It provides a structured framework for managing your finances, tracking your progress, and making informed decisions that will accelerate your journey to FIRE. By consistently using a budget template and staying disciplined with your spending and saving habits, you can take control of your financial future and achieve your dreams of early retirement.

Post a Comment